Lower-than-expected figures could provide a welcome boost to markets, while a higher-than-anticipated reading could have the opposite effect.

Estimates suggest a monthly CPI ticking lower to 0.1% (from 0.3%) and a year-on-year core CPI decreasing by 0.1%, with other indicators remaining steady.

Seeing only falling numbers should help. But we have recently seen sticky inflation has been of late.

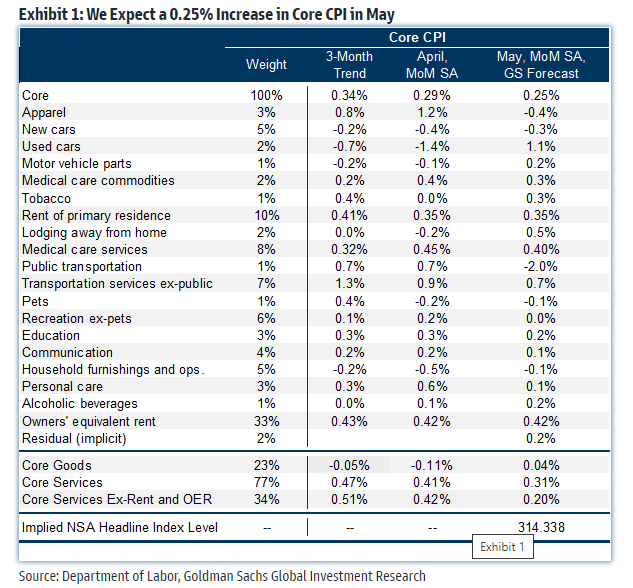

Ahead of the report, Goldman Sachs has taken a more optimistic approach, projecting a lower increase of +0.25% in monthly Core CPI data against the expected figure of 0.3%.

History suggests today’s inflation numbers could trigger these market reactions:

Remember, inflation data carries more weight than the Fed’s decision today. The Fed uses this data (and to a lesser extent, employment numbers) to guide monetary policy.

While the market’s expectation of rate cuts this year still keeps on supporting the uptrend, a post-cut environment could be more unpredictable. As the saying goes, the market discounts everything, and with the cut potentially priced in, the future may hold more surprises.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.

This article was originally published here.