Here are the most important news items that investors need to start their trading day:

After a strange week – stocks were higher despite three straight losing sessions – investors have a couple of days to breathe before some big reports roll in. Several big names are on deck for earnings this week, as market watchers look for how inflation is hitting consumers and how the strong dollar is affecting companies’ business overseas. PepsiCo’s report hits Wednesday morning, while Delta, Walgreens and Domino’s arrive Thursday. Four big banks are on the slate for Friday morning: JPMorgan Chase, Wells Fargo, Morgan Stanley and Citigroup all report before the bell. Investors will also get the latest inflation check-in Thursday, when the government releases Consumer Price Index data. Follow live stock market updates here.

Russian forces launched missiles at several cities in Ukraine, including Kiev, in their broadest attack since the earliest days of the invasion. Ukraine President Volodomyr Zelenskyy said the Russians targeted civilians and infrastructure. The strikes were apparently in retaliation for a crippling attack on a bridge that provides the only connection between Russia and the Crimean peninsula, which Russian leader Vladimir Putin’s military annexed in 2014. Putin condemned the bridge bombing as terrorism. Ukraine’s leaders used similar language to push back on Russia. “Our enemy believes that missile strikes are effective means of intimidation. They are not,” Ukrainian Defense Minister Oleksii Reznikov wrote on Twitter. “They are war crimes. Civilians are dying and getting injured. Ukraine, with the support of the civilized world, must bring the missile terrorists to justice. And will do it.” Read live updates here.

Chip stocks in China fell after the United States beefed up regulations that are intended to squeeze Chinese tech companies. Under the rules, which kick in this month, companies are required to apply for a license if they intend to sell certain semiconductors and related manufacturing equipment to China. The regulations also require foreign companies to apply for a license if they seek to use U.S. tools to produce chips they want to sell in China. Authorities in China accused the U.S. government of “abusing export controls” to hurt Chinese industry, while American officials have said the measures are important to help the United States compete more effectively in the tech space.

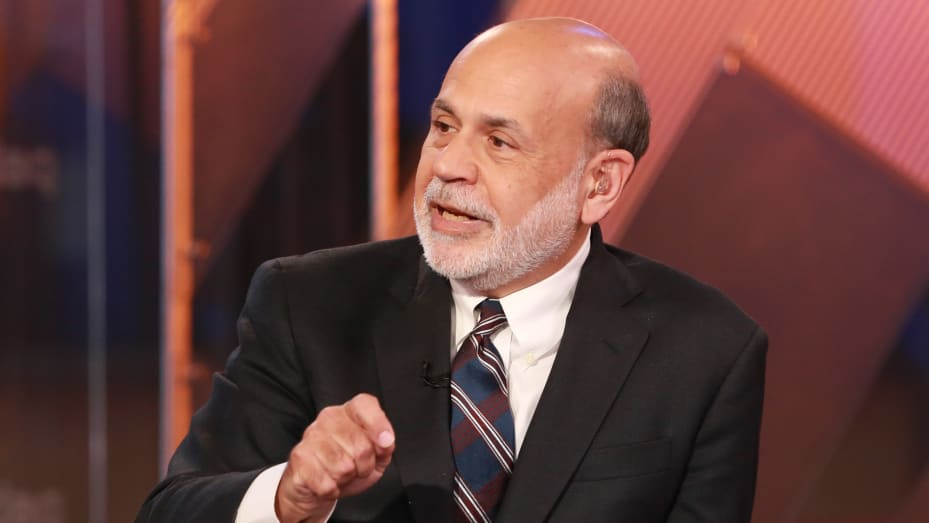

Former Fed Chairman Ben Bernanke can add another honor to his resume: Winner of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. He and two other U.S. economists, Douglas Diamond and Philip Dybvig, won for their research into the role of banks during economic crises. Bernanke, now at the Brookings Institution, is most famous for leading the Federal Reserve during the financial crisis of 2007-08 and through the U.S. economy’s recovery through 2014.

You’ve probably seen them all over your social media feeds: Uncanny, painterly pictures of everything from famous buildings to beloved pets to blood-curdling nightmares, all generated by artificial intelligence. It may seem like a fad, a tool that anyone can apparently mess with to produce striking, if fleeting, images. But many in Silicon Valley see generative AI, as the technology has become known, as the Next Big Thing. Sequoia Capital, known for backing big names like Google, YouTube and Apple early on, said the tech “has the potential to generate trillions of dollars of economic value” and alter a broad variety of industries. CNBC’s Kif Leswing takes a look at the generative AI phenomenon here.

– CNBC’s Alex Harring, Natasha Turak, Evelyn Cheng, Ashley Capoot and Kif Leswing contributed to this report.