Three companies stand out in 2024 for their extraordinary returns and significant upside potential: Applovin Corp (NASDAQ:APP), Palantir Technologies (NASDAQ:PLTR), and Vistra Energy (NYSE:VST).

These companies not only delivered stellar year-to-date performances but also maintained robust financial health, with above-average InvestingPro Financial Health Scores.

For both seasoned investors and newcomers, these stocks represent innovation and resilience in their respective industries.

What They Do: AppLovin specializes in mobile app monetization and marketing solutions, offering AI-powered tools that help developers grow and optimize their apps.

Source: Investing.com

Why It’s Thriving: AppLovin’s meteoric rise—from $39.41 at the start of the year to an all-time high of $344.77—has been fueled by surging demand for mobile gaming and app analytics.

Investors remain bullish as AppLovin capitalizes on the growing demand for in-app advertising solutions, supported by its innovative AI-driven algorithms. With further expansion into global markets, its growth trajectory remains compelling.

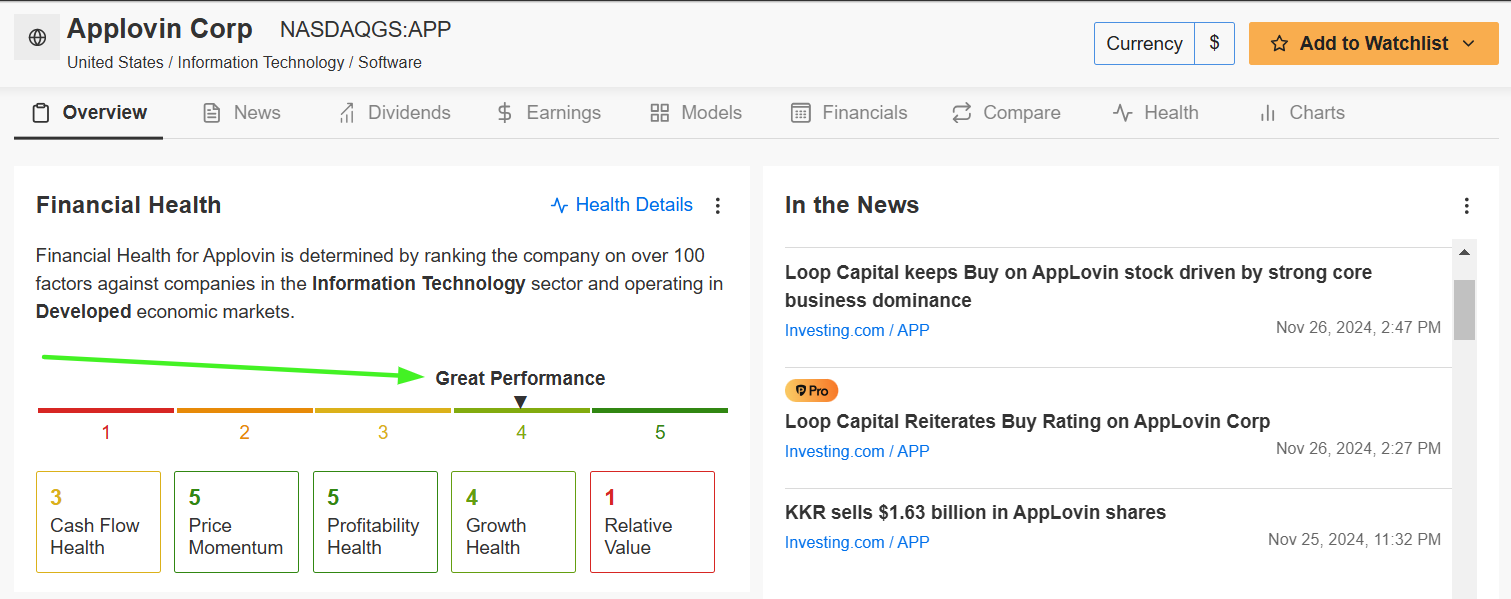

Source: InvestingPro

Its above-average Financial Health Score of 3.5 further underscores its resilience in managing growth and profitability, making it an investor favorite.

What They Do: Vistra Energy is a major energy provider with operations in traditional power generation and renewable energy, including battery storage projects.

Source: Investing.com

Why It’s Thriving: From $38.29 at the start of the year to a record $168.67, Vistra’s success is rooted in its dual strategy of embracing clean energy while maintaining its traditional operations.

The company has capitalized on the shift toward clean energy with strategic investments in renewable power and battery storage technologies. As global demand for sustainable energy solutions grows, Vistra’s investments in renewable energy infrastructure have positioned it as a leader in the sector.

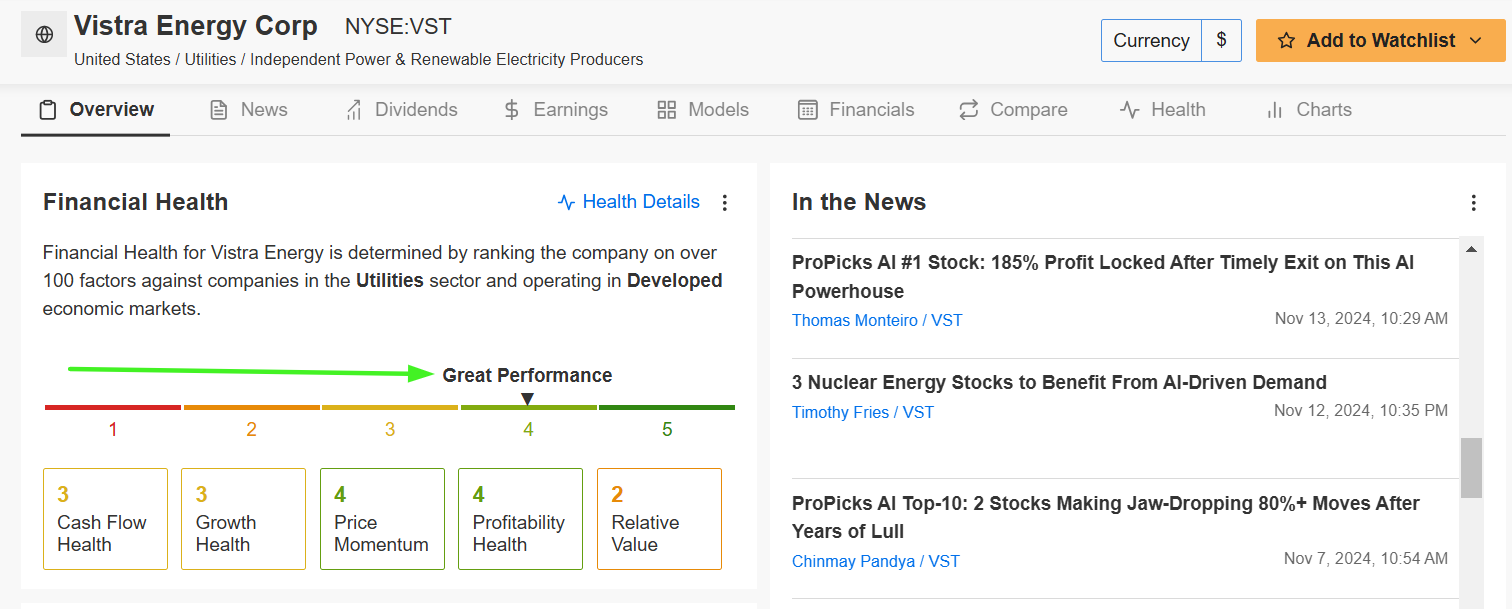

Source: InvestingPro

Its Financial Health Score of 3.2 highlights its ability to navigate the evolving energy landscape while pursuing long-term growth.

What They Do: Palantir provides cutting-edge data analytics software, primarily serving government and enterprise clients to help them make sense of massive datasets.

Source: Investing.com

Why It’s Thriving: Starting the year at $16.95 and climbing to a record $67.88, Palantir has reaped the rewards of its deep investments in artificial intelligence.

Its groundbreaking AI platform has become essential for government and enterprise clients navigating digital transformation. Palantir’s ability to secure strategic contracts and innovate in data-driven decision-making has been instrumental in its ascent.

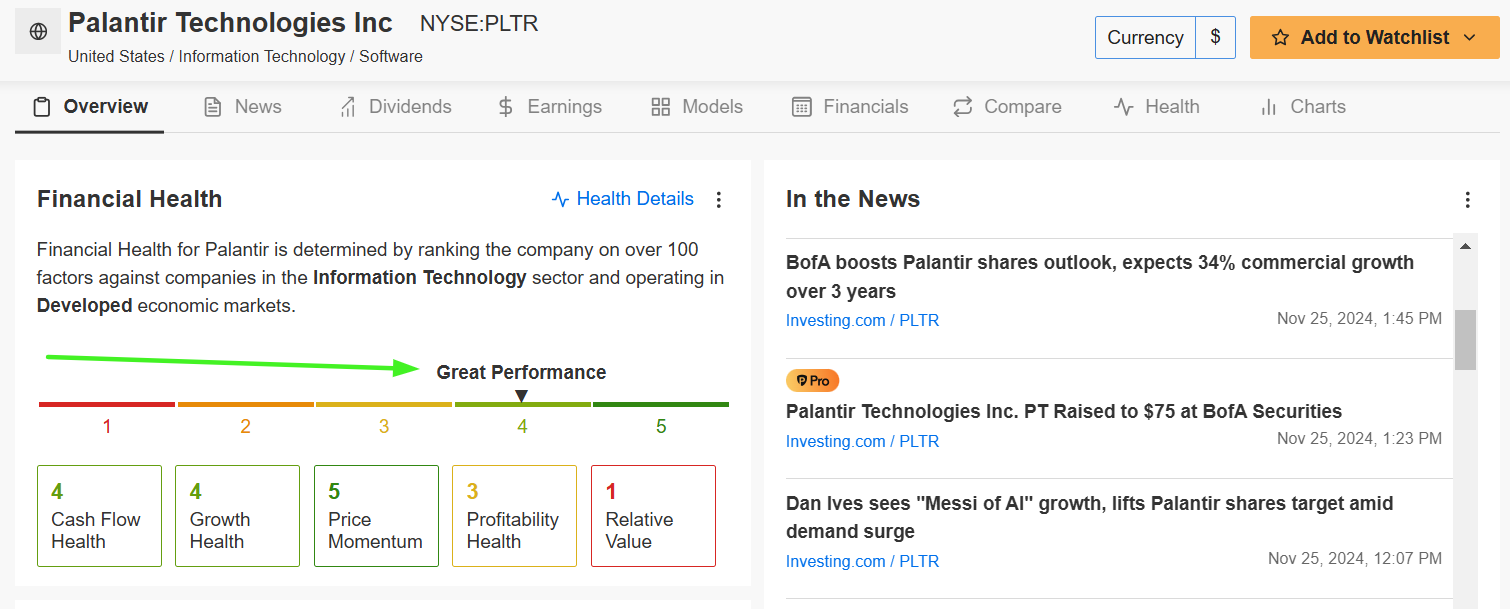

Source: InvestingPro

With a Financial Health Score of 3.4, Palantir demonstrates a balance of growth and operational efficiency, making it an attractive play in the tech sector.

These three companies exemplify innovation, adaptability, and resilience, and are well-positioned in high-growth sectors. AppLovin dominates the mobile app space, Palantir is at the forefront of AI-powered analytics, and Vistra is redefining the energy sector.

With robust financial health and strong growth trajectories, these are stocks to be truly thankful for as 2024 nears its close.

Happy Thanksgiving—and happy investing!

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get 60% off all Pro plans and instantly unlock access to several market-beating features, including:

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

This article was originally published here.