With this victory, expect the ‘drill, baby, drill’ strategy to take center stage, unleashing the full mining potential of the United States. The goal? To increase industry competitiveness and lower consumer bills.

Trump’s pick for Secretary of Energy, Chris Wright, the CEO of Liberty Energy, sends a clear message to investors: the new administration is serious about opening up U.S. resources.

If implemented, this could keep downward pressure on oil prices, although the strategy might not benefit upstream companies.

For MPLX LP (NYSE:MPLX), a U.S.-based infrastructure company focused on transportation, storage, and processing of crude oil, Trump’s election brings positive news.

Investors are hopeful that the new administration will streamline the permitting process for new pipelines and other crucial infrastructure.

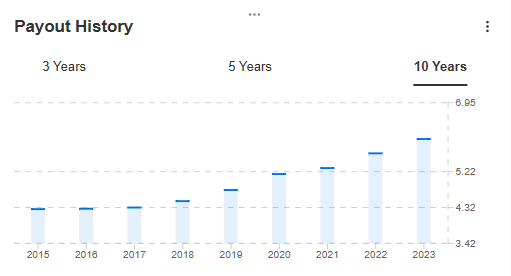

Source: InvestingPro

MPLX has already shown impressive stability, with moderate profit growth and minimal fluctuation in recent years. The company’s 7.57% dividend yield and an 80% payout ratio make it a solid pick for income investors.

The company is also well-positioned to benefit from Europe’s increasing demand for U.S. energy resources due to the ongoing war in Ukraine. This demand could drive further expansion of U.S. energy logistics and transmission capacity.

Devon Energy (NYSE:DVN), an oil and gas producer with assets in the Permian Basin and Anadarko, faces a critical juncture. The company’s stock has been trending downward since April and is nearing an important support level around $35 per share.

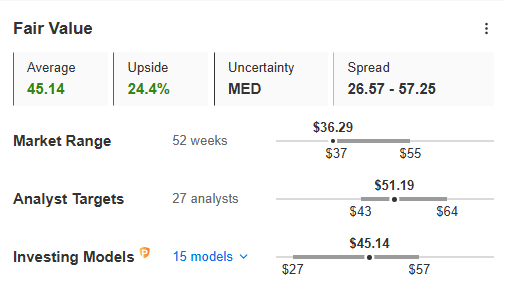

Source: InvestingPro

A rebound could align with InvestingPro’s fair value indication, which suggests a potential upside of 24%. However, a breakdown below $35 could push the stock even lower, potentially testing the $30 per share mark.

Chevron (NYSE:CVX), a major player in the U.S. energy sector with a strong global presence, appears poised for a return to an uptrend. The company’s dividend history, marked by 37 years of consecutive payouts, remains a key attraction for investors.

After recent price increases, Chevron’s stock is testing resistance at the $164 per share level. A breakout above this point could signal a return to growth.

In conclusion, with a focus on increasing domestic oil and gas production, the new administration’s policies could drive significant shifts across the sector. Keep an eye on these companies as they navigate these changes.

***

Extended Cyber Monday is here! Take advantage of 55% off InvestingPro’s advanced tools and gain the edge you need to maximize profits.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

This article was originally published here.