Why Stay At Home Stock Pickers Should Focus On Small-Cap Stocks

You as an individual investor have more opportunities, and with greater potential return than Warren Buffett has right now.

Putting most of your focus on small-cap stocks is the best way to increase alpha without making full-time travel part of your due diligence.

I’ll outline four steps that provide a logical and practical way of picking the best small-cap stocks.

You as an individual investor have more opportunities, and with greater potential return than Warren Buffett has right now at the helm of Berkshire Hathaway. There is also at least one sector industry of business that you have a better understanding of than Buffett. This means you can make a more accurate projection of future cash flows in this type of business, which is at the core of fundamental analysis. The more accurate you are with your forecasting, the better you can predict the level of success of a business.

Everyone knows Ben Graham’s maxim about the market being a voting machine in the short run and a weighing machine in the long run. If this is really the case, then we can make two key points regarding successful investing in common stock.

- In the short run, a great investment can be made in a terrible company.

- In the long run, a great investment can be made in a great company at almost any price, if it is held long enough for the power of compounding to take effect.

If the business fundamentally grows at a below average rate, your own returns can be higher than average if you bought at a cheap enough price. On the flip side, if the business fundamentally grows at an above average rate, your own returns can be lower than average if you bought at a high enough price.

The general view in business is that the bigger the company, the more its future growth is limited due to the law of large numbers. The general view in common stock investing is that since bigger companies have more coverage, the harder it is to find mispricings in the market.

This might lead one to assume the opposite is true, which would mean only investing in the smallest of microcap stocks. My opinion is that virtually the only way to gain an edge in actual microcap companies, a market cap of roughly 150 million and less, is boots on the ground due diligence. These companies are often new and don’t have much of a track record established yet to really judge the effectiveness of management. Success in this arena is more akin to early-stage VC, but not quite the same.

What this means is putting in the time and money to visit the companies and engage in Phil Fisher-style scuttle butting. On top of the costs of doing this kind of up-close analysis, interviewing management teams and making intelligent investment decisions based on the talks is a skill that has to be built. Of course, some people even recommend you avoid talking to the top management altogether since they will inherently paint a very rosy picture which can affect your judgement. After all this, there is the issue of valuation. Determining if the share price of the business is selling for less than its real value is another skill that takes time to really cultivate.

So where does this leave the stay at home stock picker? They can’t spend 300 days per year on the road, flying around doing site visits. They have no team of analysts to do this kind of work for them either. They also have little to no significant edge in the biggest stocks of the world. This leaves the small-cap arena as the ideal place for the stay at home investor.

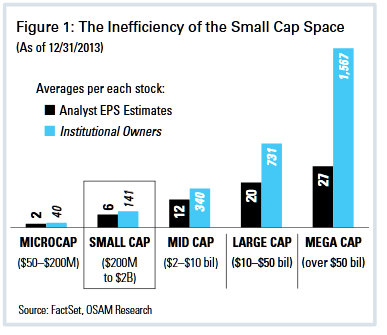

Putting most of your focus on small-cap stocks is the best way to increase alpha without making full-time travel part of your due diligence. The chart below is dated but is still relevant to where small caps sit in the range of all companies and their coverage by analysts.

Small cap can be loosely defined, I’ll just go with roughly 300 million to 2 billion in market capitalization. You will at times see people put small cap and microcap both into the category of “penny stocks.” The SEC defines a penny stock as any trading at less than 5 dollars per share. There are several stocks that have market caps over 1 billion yet trade for less than 5 dollars per share. Here are a couple of examples below. If you were the CEO of either of these I doubt you would see yourself as running a “penny stock”.

| Company | Share Price | Market Cap | Revenue |

| CNR | 5.85 | 664.81 million | 4.94 billion |

| COTY | 4.39 | 2.54 billion | 7.93 billion |

I generally don’t like using the term penny stocks since it usually connotes companies that are tiny, very high risk, or frauds, bankruptcies, etc.

This isn’t pink sheets or risky OTC stocks. I’m making the case for small-cap stocks that trade on a major exchange, or OTC in the case of some larger international companies where the OTC stock is simply the best way for Americans to invest. Unless you are a fund manager who has to worry about redemptions, liquidity shouldn’t be an issue for you as an individual investor in the small-cap space as I’m defining it. This is another advantage that small-cap stocks have over microcaps, which have more risk due to liquidity issues in very thinly traded stocks. Liquidity will definitely increase if a microcap stock pick performs well and reaches a higher valuation, but working your way into the position as a tiny, illiquid company can be trying.

Small caps are companies that are most definitely past the startup phase, and have a somewhat significant moat established already. While they are far beyond the startup days, they are far and away from being blue chips. Of course, it can also be a formerly large company that is well past its glory years, think Eastman Kodak or Macy’s. Obviously, what we want to be able to do is find the small-cap companies that will grow to be mid-cap companies or in the best case large caps. Much easier said than done. This requires the ability to assess the company on a qualitative basis and purchase shares when they are undervalued as well. You can achieve market-beating returns by growth or value investing, but if you’re truly looking for returns of 10x and beyond, you must combine growth with value.

Total return is defined as the combined return from capital appreciation and any dividends/interest. I think the better way to look at the total return of a stock is to instead try to gauge how much of the performance came from compounded growth of the company, and how much came from the share price rising due to non-fundamental factors. In other words, how much came from growth and how much came from value?

No Shame in Being a Stay at Home Investor

Consider that the private equity funds that do beat the US stock market put in tremendous effort to do so. In the typical case of a leveraged buyout, the firm not only takes on debt to make the purchase, but the management team is usually replaced in order to extract value out of the acquired company that presumably couldn’t have been done with the previous management. This is very tough work. Even the biggest and most well-known PE firms have had disappointing investments of varying sizes. If you pick a stock and you lose it all, you still get to keep chugging along. If a PE firm loses it all (or generates subpar returns), they not only lose the money provided by multiple investors and institutions, they lose some reputation which makes it harder to raise funds in the future. The same goes for venture capital funds, hedge funds, and publicly traded active funds.

In the book “Private Equity 4.0-Reinventing Value Creation”, the authors make what I think to be a rather stunning admission in the introduction.

The buy-and-sell approach: capitalism on speed

Finally, it is important to stress the value of the buy‐and‐sell approach that is said to characterize private equity as investors. It is fundamentally different from the traditional buy‐and‐hold approach a‐la‐Warren Buffett. Buffett was once quoted as saying that his favorite holding period for an investment was “forever”, and that is very much the way many investors still operate. And there is nothing wrong with that business model, except maybe its disconnection from a pressing deadline to meet.

Private equity to a large extent is capitalism on speed: by providing tight investment horizons, it forces a quick realization of the value potential. Is this better than what could be achieved through a buy‐and‐hold approach? Probably not, but it achieves results faster. And in a world where uncertainties are increasing, not decreasing, having a tighter time frame for value creation is probably ever more important”

The “disconnection from a pressing deadline to meet” is something the stay at home stock picker should use to their advantage.

There is no requirement to fully unlock the value of your investments in under five years, no need to be fully invested at all times, and there is certainly no mandate to buy dozens of stocks. No one will be blowing up your inbox regarding redemptions if the portfolio takes a hit. Buffett himself is greatly constrained by the size of purchases he must make at this point. So this literally means that you as an individual stock picker have advantages that Buffett doesn’t have.

My point is to show the things that private equity firms do go through that you as an individual common stock investor don’t have to:

| Private Equity | Individual Stock Picker |

| Use of leverage to acquire company | No debt needed, but margin loans are available. |

| Paying at least enterprise value for the acquisition | Paying the share price the market offers |

| Incurring all legal costs associated with the acquisition | Paying a small trading fee to an online brokerage |

| Implementing new management to turnaround the business | Continually monitor the fundamentals at home from your screen |

| Finding the right seller when the time comes, and negotiating the right price | Near instant liquidity during trading hours through an online brokerage |

| Incurring all the associated legal costs of the sale. | Again, a small trading fee paid when selling. |

Successful investing in common stock does require a time commitment when it comes to fundamental analysis and monitoring current positions, but it’s nothing compared to using debt to take over a business and turning it around for resale in a few years. This is what should make anyone excited about investing in common stock. While picking individual stocks does mean you are an active investor, the nature of common stock investing is passive insofar as you don’t have the responsibility of operating or directing the company after you invest.

Fortunately, there are many hundreds of companies in the small-cap realm, and even more if you extend the market cap range from say, 100 million to 4 billion. So here are the four steps for stay at home investors to use to find the right small-cap stocks. Three of these can be screened easily, while the other requires deep research.

1. Small Market Capitalization

The potential returns are almost always higher due to the fact that smaller companies have much more room to expand. The small-cap index has outperformed the S&P 500 over the long run, and this isn’t because the small-cap companies are inherently better, they just offer more potential room to grow due to the law of large numbers.

I will add a caveat in that I personally think that some of the FAANG stocks will prove to be unique exceptions to the law of large numbers. Apple (AAPL), Google (GOOG), and Amazon (AMZN) all have more room to grow due to the unique circumstances of each business. The potential growth for these companies is wholly different that most others.

Nevertheless, the catch is that most small-cap companies won’t grow into much bigger ones. This is why I advocate a very focused approach to small caps. The point is not to bet on small caps in general, it is the ones that will compound their way to market-beating returns.

2. Sector/Industry

This is where core competencies come in. No one can know it all, so you have to tilt the odds in your favor by simply looking into sectors or industries that you feel you have some understanding of. At the core of common stock investing is making intelligent forecasts about the success, or lack thereof, of particular companies. The greater your understanding of a particular sector industry, the more

Small-cap stocks offer another advantage in that there is usually one main line of business, which makes things simpler and easier to analyze. Gaining a thorough understanding of all the ways Google or Microsoft (MSFT) brings in revenue is much more strenuous than having the same understanding of Party City (PRTY) for example.

3. Above Average ROE and ROIC

Next up is an area that can’t be screened. For a company to achieve 10x, 20x, or higher returns they must be able to sustain a high ROIC over a multi-year period to create a literal compounding machine. There is simply no way around this. The chart below shows the necessary growth rate and number of years to reach the mystical 100-bagger that every stock picker wants but so few actually achieve.

| CAGR | Years to 100X returns |

| 14.06% | 35 years |

| 16.6% | 30 years |

| 20.23% | 25 years |

| 25.89% | 20 years |

| 35.94% | 15 years |

| 58.49% | 10 years |

| 151.9% | 5 years |

Incidentally, this is why I am strongly in favor of companies tying the executive bonuses largely to the results of ROIC. When this is used in combination with paying those bonuses primarily in equity compensation, specifically restricted stock (not options) with long vesting periods, instead of cash, this creates an extremely powerful use of incentives. This exact method is rarely used in the corporate world however as options are prevalent.

The ROIC is something that needs to be explored in depth and put in proper context.

When it comes to looking at the ROE and ROIC, it’s important to look over a 5-10 period to see the true average of these measures. Don’t merely rank the companies by the previous year ROE/ROIC. Moreover, the length of the CEO’s tenure should be taken into account. The five-year average ROIC might not make much sense if the company went through three different CEOs during that time frame. A more appropriate way of doing it might be to give each CEO tenure its own average ROE and ROIC.

There are many factors that need to be taken into account when studying ROIC. First is to note the management team’s style and track record. The bigger a publicly-traded company becomes, the more capital allocation becomes a vital part of the CEO’s job. You need to study the management team to know what to expect in the future. Have past acquisitions panned out? Has organic growth been a key driver? Does the CEO come from a sales and operational background with little capital allocation experience?

It’s important to note that a high ROIC doesn’t necessarily equate to brilliant capital allocation. A company can have great ROIC but could be doing a poor job of allocating capital. They could be buying back shares at overvalued prices, paying too high a percentage of earnings towards dividends, or paying down debt too slowly in spite of high returns. So in addition to each CEO tenure having its own average ROE/ROIC, you should create a capital allocation scorecard as well.

If a small company pays no dividend, doesn’t engage in buybacks, and has little to no debt, then it simplifies the capital allocation picture and lets you know that organic growth and/or acquisitions are the driver behind overall growth at this point. If you then uncover that acquisitions have been minimal or non existent, then organic growth has been the key driver. Analyzing the effectiveness of the company’s pure ability to grow is basically a different sport than analyzing the capital allocation ability of the CEO of a large, mature and diversified company.

I’m not giving a hard and fast rule about the hurdle rate for ROE/ROIC. Instead just look for anything above average, which is around 10%, sometimes a little higher. A 10-year track record of high returns on capital is still not enough, your job as an investor is to find out why a company is achieving sustainably high returns on capital. You can’t always find out exactly why, but you need to always be reaching for this information. The more clarity you have on this key issue, the more you will be able to accurately project the company’s performance.

4. Low Share Price and Multiple

This is the lazy way to do valuation. If a stock rises 10x or more, it usually won’t happen without one of the common multiples being somewhat low though at the start. Again I’m not giving a hard and fast rule about what to look for. If you’ve built a solid understanding of the company qualitatively, this will better inform you as to what being undervalued actually looks like.

The core of what a DCF analysis tries to bring to you is legitimate, but the formula requires your own subjective projections of the future cash flows. Imagine that two or three years ago you use a DCF on any given airline, hotel, or cruise line stock. Obviously, the black swan known as COVID-19 would make the previous DCF useless. I’m not saying the DCF has no merit at all, but it does have limitations and therefore shouldn’t be the sole means of valuation.

Looking for a low share price and low multiple is simply a way of gauging negative sentiment after you’ve judged the future prospects of the company to be solid. If the sentiment seems unnecessarily low based on your qualitative understanding, then it is time to act.

Risk and Volatility

I’d like to briefly talk about volatility and risk. When it comes down to you as an individual, you have no control over the company or the stock price. Ultimately, the risk lies in the investor, not in the investment. You as an individual investor can’t change the outcome of the company unless you become an activist or control investor. The only thing you have control over is what to buy or sell and when to buy or sell.

Volatility is not your enemy

Volatility does not guarantee greater risk, nor does it guarantee greater returns. Low volatility and high compounded returns might sound ideal, but what this really means is that there will be fewer attractive entry points. For an active investor, volatility creates lower share prices which is what precedes multi-bagging returns. Many case studies, including the one I will present below, show the great returns only when it was timed absolutely perfectly. You simply can’t count on ever timing the bottoms and tops perfectly.

How can the stay at home stock picker make the most effective use of their time in terms of analysis?

I’m afraid I have no hack for this. There is simply no substitute for continuous research. The quote below expresses this point quite well.

“The research process itself, like the factory of a manufacturing company, produces no profits. The profits materialize later, often much later, when the undervaluation identified during the research process is first translated into portfolio decisions and then eventually recognized by the market.

In fact, often, there is no immediate buying opportunity; today’s research may be advance preparation for tomorrow’s opportunities. In any event, just as a superior sales force cannot succeed if the factory does not produce quality goods, an investment program will not long succeed if high-quality research is not performed on a continuing basis.” Seth Klarman

There isn’t enough time to qualitatively study the business and go through a proper valuation for each one. Assuming you stick with one sector within the small-cap space, how long will it take for you to study hundreds of companies, and then see which ones are the most undervalued? Thus, I think it’s wiser to create a watch list based purely on qualitative factors.

Answering this one question will chiefly sum up the qualitative aspects. Is the company poised for above-average returns on capital in the future, yes or no? If no, they don’t belong on your watch list. Move on to the next company. If yes, then two more questions follow. Roughly how much higher than average, and at what price will this reflect in your own personal returns?

This is why the better strategy is to fish in the pond of businesses with high ROE/ROIC, and only focus on price after you have become extremely acquainted with the business qualitatively. To be clear, this does not mean simply screening small caps by ROE and investing in all of the top ones. You have to dig deeper. There are only so many businesses that will rank high qualitatively, so your edge should be a thorough understanding of each company.

If you find a company with very low returns on capital, declining margins, and declining sales or earnings, there isn’t much point in doing a deep dive into previous 10Ks. Time is scarce, so don’t waste it on deep research on low-return businesses.

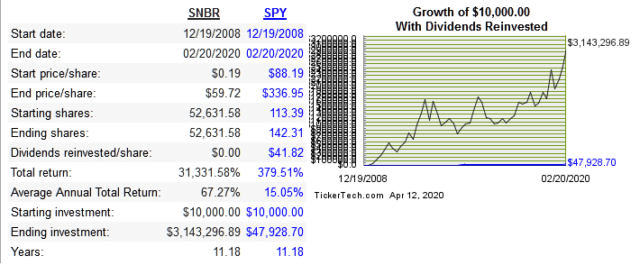

Case Study – Sleep Number Corp. (SNBR)

As I stated earlier, the true way to look at total return is to determine how much of the performance is driven by the company’s fundamentals and how much is just market fluctuation. You can never know with absolute precision how much comes from each, but with this case study, I will try to come to an approximation.

The returns here are extreme because the timing is perfect in this scenario, and you should never expect to actually achieve returns like these. This business is cyclical, consumer discretionary, highly levered, and is an aggressive buyer of its own shares. All are definite factors into the performance over this time period.

*Remaining data by morningstar and gurufocus.

| Starting Market Cap 11.3 million | Ending Market Cap 1.49 billion |

| Starting EV 78 million | Ending EV 2.08 billion |

| Starting P/E 9 | Ending P/E 22.2 |

| Starting P/S 0.02 | Ending P/S 1.01 |

| Starting Shares Outstanding 55 million | Ending Shares Outstanding 30 million |

10-Year CAGR of Revenue 10.85%

10-Year CAGR of Net Income 9.87%

Imagine you own a private business, and you grew EBIDTA from 11.3 million to 1.49 billion over an eleven-year period. This is a CAGR of 55%, which is beyond phenomenal. Of course, SNBR didn’t grow EBIDTA or net income at that rate. Their top and bottom lines grew at an average rate, so why did the market reward this company so much? The answer lies partly with our old friends, ROE and ROIC.

8-year average ROE 43.54%

8-year average ROIC 42.67%

The rest can be explained by market fluctuations. The starting point was the very bottom of the 08 crisis (max pessimism) and the end was at the very top of a decade long bull market (max optimism).

How many small-cap stocks should I own in my portfolio?

There is no objective right or wrong answer to this question. It mostly depends on how much money you have available to invest. The bigger the amount, the more difficult it will be psychologically to have a concentrated portfolio.

While I’m again not giving a hard and fast rule, I favor the approach by Mohnish Pabrai of simply looking for 2 to 3 good stocks per year. As an individual investor, there is no pressure to be fully invested as is the case with money managers. This can vary of course, and logically there should be better prices for almost any company this year as compared to this time last year.

Compare these two cases. In Case A, the investor saves $1,000 each month and waits until they have $10,000 before entering a new position with that sum. In Case B, the investor just inherited a lump sum of $500,000 after tax and they decide to invest it. Without knowing anything else about each investor, what do you think their portfolios would look like?

My guess is that Case A will be more concentrated and more quality focused. Especially if it took the investor 10 months to build up to $10,000, they won’t be so quick to deploy it into a large number of stocks.

Even if Case B invested in only 8-10 stocks, it’s probable that they bought all ten within a relatively short time frame. There would naturally be an imperative to fully invest the sum quicker rather than wait it out.

The biggest issue with being very concentrated is when new opportunities arise. Selling your best winners to buy a new stock is not ideal. This is why I think some focus should be put on cash generation within the portfolio, especially for a smaller portfolio. That is not the scope of this article though.

One short note on the “type” of investor you are. Don’t be so quick to put yourself into any camp and feel like you need to stay dedicated to it your whole life. As a stay at home investor, you can theoretically allocate a portion of your portfolio to purely growth stocks, a portion to deep value stocks, another portion to Buffett style stocks (great business at a fair price), another allocated to a dogs of the Dow strategy, and yet another portion strictly using the magic formula method. I do personally think that these many allocations are far too many. A concentrated portfolio is a simplified portfolio. Develop a niche and stick to it, but don’t be afraid to satisfy some cravings for alternative methods like those just mentioned with smaller amounts of your capital.

Conclusion

I’m trying to provide solid guidelines without too many hard and fast rules. These are the things needed to tilt the odds in your favor. You might be wondering about things that I didn’t mention here which are still important though. Things such as market share, capital structure, share structure, insider ownership, executive compensation and more. All of these are part of fundamental analysis and shouldn’t be neglected.

It’s true that the odds of any individual consistently beating the market are low. It’s also true that passive investing in an index fund is a surefire way to build wealth in the long run, as my last article showed. This shouldn’t discourage you from picking stocks in the right way. If you have a long term time horizon and a willingness to do deep research, you are already at an advantage over those who casually buy stocks with little due diligence and sell as soon as the price declines.

The four steps I’ve outlined are not magical and come with no guarantee of results. They are simply logical and practical steps to help you beat the market from home with small-cap stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As originally posted on seekingalpha.com