In a strategic move, Microsoft Corporation (NASDAQ:MSFT) secured a deal with Constellation Energy (NASDAQ:CEG) to revive the Three Mile Island nuclear plant, tapping into its power to fuel their data centers.

This shift marks the beginning of Big Tech’s pivot toward nuclear energy, driven by AI’s insatiable need for electricity.

Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) aren’t far behind.

Both have announced plans to power their data centers with small modular nuclear reactors (SMRs), signaling a broader trend as companies race to secure energy alternatives.

With the U.S. and China vying for dominance in AI, the demand for reliable power sources like nuclear will only accelerate.

As a result, nuclear power stocks and uranium—a critical resource for nuclear energy—have surged.

But which stocks are best positioned to ride this wave and capitalize on Big Tech’s investments? Let’s dive into three companies that could benefit the most.

Vistra Energy (NYSE:VST) boasts a diverse energy portfolio, which includes natural gas, solar, battery storage, and nuclear power.

With a capacity of about 39 GW, the Texas-based company is well-positioned to meet the growing demand for clean energy solutions.

Source: Investing.com

Analysts surveyed by Investing.com project a 12.1% upside, with a target price of $141.41, up from $126.11 on Oct. 23. The stock holds strong ratings with 14 buy recommendations and only 1 sell.

As AI’s energy needs soar, these companies stand to benefit from the renewed focus on nuclear power, making them ones to watch in the coming years.

Xcel Energy (NASDAQ:XEL) is another player poised to benefit from the surge in nuclear demand.

Based in Minneapolis, the utility giant has a market cap exceeding $35 billion and aims to achieve 100% carbon-free electricity by 2050.

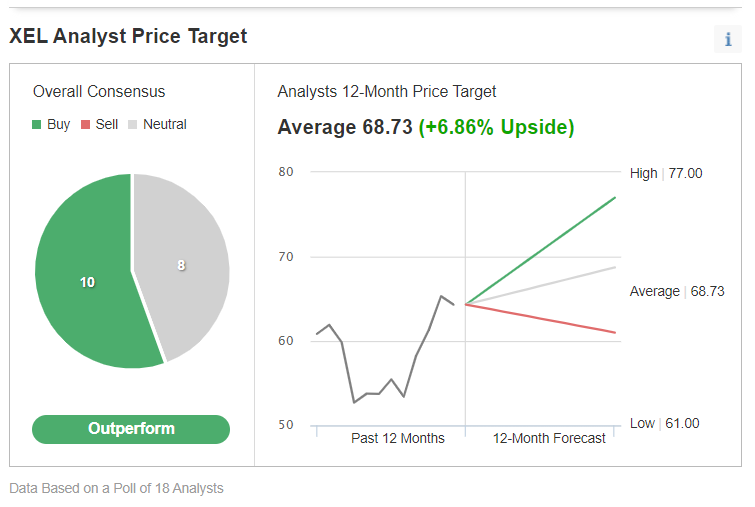

Source: Investing.com

This ambitious goal will drive its reliance on nuclear energy, making it a key beneficiary of the shift toward clean power.

Analysts forecast a 6.8% gain, setting a target price of $68.73, up from its recent close of $64.32 on Oct. 23. The stock has an “Outperform” rating with 10 buy and 8 hold recommendations.

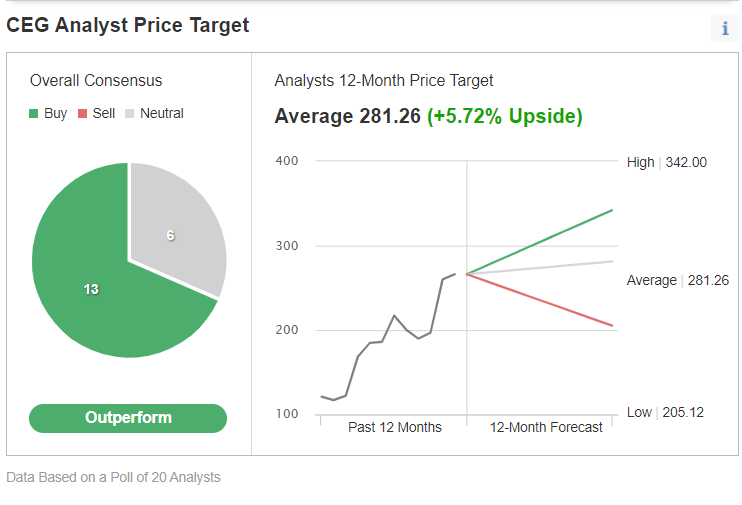

Constellation Energy is at the forefront of this nuclear revival, thanks to its landmark deal with Microsoft.

Since its 2021 launch in Baltimore, the company has rapidly expanded, supplying energy to nearly 2 million customers across the U.S. through a mix of nuclear, wind, solar, natural gas, and hydroelectric plants.

With a market cap of over $83 billion, Constellation is well-positioned to grow.

Source: Investing.com

Despite a 50% rally in the past three months, analysts see further upside potential, estimating a 5.7% increase from its recent close at $266.05 on Oct. 23. The stock holds strong support with 13 buy and 6 hold ratings.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.

This article was originally published here.