The grey metal often lags behind gold’s moves, and this time is no different, as it follows gold’s upward trend.

Fundamental forces are driving the metal’s surge, including ongoing supply shortages and the Fed’s monetary easing, with another 25 basis point cut expected in November.

The demand outlook for silver remains bullish. Supply and demand fundamentals point to continued buying pressure, with forecasts from the Silver Institute projecting a demand of 1.219 billion ounces in 2024, outpacing a supply of just 1.004 billion ounces. Several key factors are driving this imbalance:

Silver prices are testing key resistance at $35 per ounce, a level last seen in 2012. If the bulls manage a breakout, the next target will be around $37 per ounce.

However, with momentum firmly in their favor, there’s potential for prices to push above $40 in the near future.

The silver market remains one to watch as a combination of fundamental and technical factors suggests further upside is possible. Traders should be ready to capitalize on any opportunities as silver’s rally continues.

If you’re looking for another way to tap into silver’s potential bull run, Fortuna Mining Corp (NYSE:FSM) offers an attractive opportunity.

This Canadian miner, focused on precious metals like silver, gold, and lead across South America, stands to benefit from rising commodity prices.

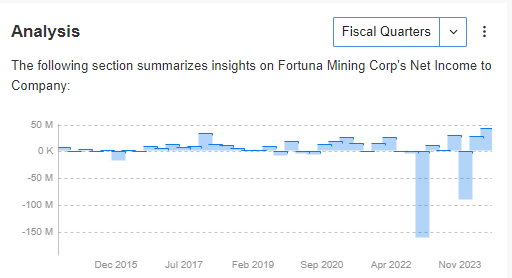

Source: InvestingPro

Recent improvements in net profits, which have returned to positive territory in the last two quarters, are a promising sign for continued growth.

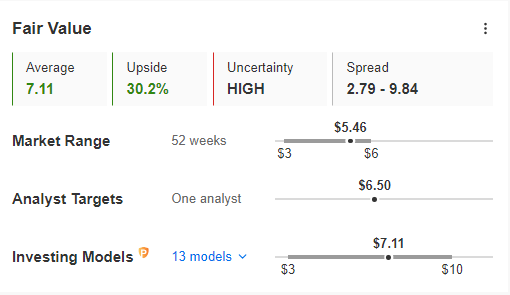

According to InvestingPro, Fortuna’s fair value index suggests there’s more upside to come, with the potential to break past this year’s highs—levels not seen since 2021—above $7 per share.

Source: InvestingPro

This represents a 30%+ upside, offering investors a compelling alternative to simply holding silver.

As both silver prices and Fortuna’s performance gain momentum, this mining stock could serve as a strategic play for those looking to capitalize on the broader metals rally.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

This article was originally published here.